It is not unusual for entrepreneurs who run e-commerce businesses to face challenges in managing the financial nuances. However, using a WooCommerce Tax plugin can make this complex task manageable.

These plugins can assist a company in its tax calculation automation and compliance of taxes based on local, state, and international tax laws and regulations.

In this blog post, you will find the list of the most suitable WooCommerce tax plugins so you can save time and manage taxes effortlessly and efficiently.

Use Relay to pay affiliate commissions with tax compliance.

Importance of Tax Compliance in WooCommerce Stores

Tax compliance is important in the WooCommerce store as it isn’t just a requirement but a non-negotiable necessary to be followed. Each country has its own tax calculation and sales tax management rules.

A WooCommerce plugin for tax simplifies the process of staying compliant with tax regulations. You can automate tax calculations based on different cities, states, and countries. With the right WooCommerce tax plugin, you can also automatically file for returns. Multi-country tax variations and VAT management can also be done effortlessly.

A tax plugin in WooCommerce helps to automatically manage:

- Precise tax rate calculations

- Follow tax exemptions

- Comprehensive tax reporting

By having all your tax-related data handled using one plugin, you can never miss important data or dates. Additionally, you can save hundreds of hours in manual calculations and prevent potential legal complications.

Must-Have Features of a Tax Plugin in WooCommerce

The must-have features of a Tax plugin in WooCommerce to make tax management seamless and efficient for store owners are:

1. Automation

One of the primary advantages of using WooCommerce tax automation tools is the ability to automate tax calculations. These plugins calculate tax rates automatically based on customer location and product details. This can save time and ensure fewer errors occur. With WooCommerce’s automated tax solutions, you can handle tax complexities without manual error.

2. Multi-region Support

If your store caters to international customers, opting for multi-country tax plugins for WooCommerce is essential. These tools ensure your store complies with local, state, and international tax laws. They simplify handling multiple tax compliance. This will be perfect for businesses aiming to expand their reach globally or handling business in multiple locations.

3. VAT Management

For businesses operating within or selling to EU countries, VAT management plugins WooCommerce will be helpful. You can manage VAT obligations and ensure compliance with EU VAT regulations. The WooCommerce VAT calculation plugins allow for accurate tracking and charging of VAT based on customer location.

4. Real-time Tax Calculation

Your tax calculation for the WooCommerce store must happen following changing tax regulations. The best tax plugins for WooCommerce provide real-time tax calculators for WooCommerce stores by automatically applying accurate rates during checkout. This feature is suitable for businesses operating in regions where tax policies frequently change.

5. Compliance Features

Staying compliant with global tax laws is a priority for any e-commerce store. WooCommerce plugins for tax compliance ensure your store adheres to regional tax requirements like EU VAT and US sales tax. You can rest without fear of tax-based penalties or audits.

6. Reporting Tools

Tax reporting is crucial for filing taxes accurately and on time. The WooCommerce tax reporting solutions will offer complete reports on sales tax, VAT, and other applicable taxes. With these sales tax reporting WooCommerce plugins, you can streamline your tax filing process and avoid discrepancies in tax submissions.

By integrating advanced tax plugins for WooCommerce, store owners can benefit from features like tax rate calculations and accuracy. These features enable eCommerce businesses to handle complex tax scenarios with ease.

Benefits of Using WooCommerce Plugin for Tax Management

Using a tax plugin for WooCommerce offers several advantages:

- Time-saving: Automating tax calculations eliminates the need for manual tasks. This frees up resources for other business tasks.

- Accuracy: The WooCommerce tax calculations are always accurate with a plugin. This reduces the risk of errors.

- Global Compliance: WooCommerce plugins for tax automation let your store align with international tax standards as well as apply relative tax based on the customer location.

- Adoption: Consumer taxes including the Value Added Tax (VAT) within the EU, the Sales Tax within the United States, or any other regional taxes can be managed via a WooCommerce tax plugin.

- Seamless Integration: Most tax plugins integrate seamlessly with WooCommerce. You can have a hassle-free setup and operation.

- Reporting Tools: Plugins with WooCommerce tax reporting solutions help you track and report taxes efficiently. This can be highly helpful when it’s time for filing.

Take control of your affiliate partnerships—manage payouts with tax compliance with Relay.

8 Best WooCommerce Tax Plugins for 2024

1. WooCommerce Shipping & Tax

Product Overview:

The WooCommerce Shipping & Tax plugin helps to calculate taxes and shipping for WooCommerce online stores.

This WooCommerce tax plugin is faster than any other tax plugin as it is hosted on Automattic’s in-house infrastructure. It calculates tax rates, does not require manual input, and can be easily incorporated into your WooCommerce store dashboard.

Key Features:

- Automated Tax Calculations: Calculate accurate taxes at checkout without manual configuration.

- Seamless Integration: Access all features directly within your WooCommerce dashboard.

- Shipping Label Savings: Print USPS and DHL shipping labels and save up to 90%.

- Global Tax Compliance: Manage regional tax laws effortlessly for international and domestic sales.

2. TaxJar – Sales Tax Automation for WooCommerce

Product Overview:

Using TaxJar for WooCommerce stores minimizes the burden of managing taxes because this software automates tax calculations, reporting, and filing of sales taxes. This WooCommerce tax plugin with real-time tax rates and quick integration saves hours of work, as well as dynamically deals with state and local legal requirements.

Key Features:

- Real-Time Tax Rates: Instantly calculate sales tax at checkout with 99.99% uptime for accurate results.

- AutoFile Returns: Automatically file state tax returns to avoid missed deadlines.

- Detailed Tax Reports: Generate jurisdiction-level reports for quick and easy filings.

- Economic Nexus Tracking: Identify where your sales exceed economic thresholds to ensure compliance.

3. WooCommerce AvaTax by Avalara

Product Overview:

Avalara AvaTax is a WooCommerce tax plugin that calculates sales taxes automatically, and accurately with consideration to more than 13000 US taxing districts. This tool helps customers to track their tax compliance and manage their tax needs for domestic and international business.

Key Features:

- Real-Time Tax Calculations: Calculate accurate sales tax, customs duties, and import taxes at checkout.

- Economic Nexus Tracking: Monitor state and country tax liabilities with automated tracking tools.

- Comprehensive Product Taxability Rules: Apply precise tax rules across a vast product catalog.

- Exemption Certificate Management: Collect and maintain exemption certificates digitally.

- Automated Filing & Remittance: Simplify tax filing with Avalara handling submissions to local authorities.

4. WooCommerce Quaderno

Product Overview:

Quaderno Tax plugin for WooCommerce provides integration of taxation system, which supports the rules of taxations of the USA, EU, and CA that includes sales tax, VAT, and GST respectively. In addition to real-time updates and auto-generating of receipts, it makes it easy for new and growing WooCommerce businesses to manage taxes.

Key Features:

- Automated Tax Calculations: Instantly calculate accurate taxes based on customer location and product type.

- Compliance Notifications: Receive alerts for new tax obligations or rate changes across regions.

- Instant Tax Reports: Access ready-to-use tax reports for seamless filing.

- Automated Invoicing: Send tax-compliant receipts and credit notes in multiple languages and currencies.

- Effortless Setup: Get started within minutes with a user-friendly interface.

5. YITH WooCommerce EU VAT

Product Overview:

YITH WooCommerce tax plugin is best for any business that holds a high market in the European region as they offer VAT calculation for all orders.

Key Features:

- Automatic VAT Calculation: Geolocate customers and charge the correct VAT for B2C transactions.

- B2B VAT Exemption: Validate and exempt EU VAT numbers at checkout for business customers.

- OSS Reporting: Generate and export One-Stop-Shop tax reports in CSV format for compliance.

- IOSS Integration: Charge VAT for orders up to €150, avoiding customs delays.

- EU Sales Restrictions: Block orders from customers located in specific EU regions.

6. WooCommerce Taxamo by OPMC

Product Overview:

WooCommerce Taxamo by OPMC will help to maintain the fulfillment of the EU VAT for digital goods. This WooCommerce plugin properly gathers, calculates, and pays VATMOSS and uses the dependable API of Taxamo for real-time tax handling.

Key Features:

- Accurate EU VAT Calculation: Determines VAT rates based on customer location and cart contents.

- Real-Time Tax Management: Captures up to six location records per transaction without disrupting the customer experience.

- VATMOSS Compliance: Routes collected VAT to the correct mini-one-stop-shop locations automatically.

- Comprehensive Reporting: Generates downloadable EU MOSS returns and audit files for compliance.

- Easy Integration: Connect your WooCommerce store to Taxamo for end-to-end tax management.

7. EU/UK VAT Compliance Assistant for WooCommerce

Product Overview:

The EU/UK VAT Compliance Assistant ensures that WooCommerce store owners remain compliant with EU and UK VAT. This WooCommerce tax plugin calculates the value-added tax, verifies the location of the customer, and provides various reports to eliminate a great deal of paperwork for online stores that operate in international markets.

Key Features:

- Accurate VAT Calculation: Automatically calculates VAT rates based on customer location and products in their cart.

- GeoIP Customer Identification: Verifies customer location using IP, billing, and shipping addresses.

- Currency Conversions: Stores VAT data in the required reporting currency with live conversion rates.

- Advanced Reporting: Export OSS/MOSS/IOSS reports by country, VAT type, and rate.

- Dynamic VAT Display: Shows accurate VAT-inclusive pricing from the first customer interaction.

- Mixed Shops Support: Handles VAT for digital and physical goods under different taxation rules.

- Brexit-Ready: Fully compatible with EU and UK post-Brexit regulations.

8. Vertex WooCommerce Tax

Product Overview:

Vertex is designed to offer tax management solutions in WooCommerce. With this WooCommerce tax plugin, users can have credible calculations of the indirect tax, meet multi-jurisdictional compliance, and integrate for improved functionality.

Key Features:

- Cross-Border Compliance: Streamlines VAT filings and multi-country tax management.

- Seamless Integration: Compatible with WooCommerce, ERP, and other systems.

- Document Management: Handles tax certificates and exemption documentation.

- Data Insights: Provides tax-specific analytics to minimize risks and optimize strategies.

- Managed Services: Expert assistance for setup, compliance, and reporting.

- Industry-Specific Solutions: Tailored tax tools for various business needs.

Selecting the Right Tax Management Solution in WooCommerce

To select the right WooCommerce tax plugin, evaluate your:

1. Specific business requirements

If you sell digital downloads internationally, choose a tax plugin for WooCommerce like TaxJar that handles complex digital product tax rules.

2. Transaction volume

For high-volume stores processing over 1,000 transactions monthly, select a robust WooCommerce tax plugin like Avalara that can handle bulk tax calculations efficiently.

3. Target market regions:

If you’re primarily selling to European customers, opt for a plugin like WooCommerce EU VAT that specializes in European tax compliance.

4. Budget constraints:

For small businesses with limited funds, the free WooCommerce Tax plugin might suffice, while larger enterprises might invest in comprehensive solutions.

5. Scalability needs

Choose a cloud-based tax plugin like Vertex that automatically updates tax rates and can seamlessly grow with your expanding e-commerce business across multiple sales channels.

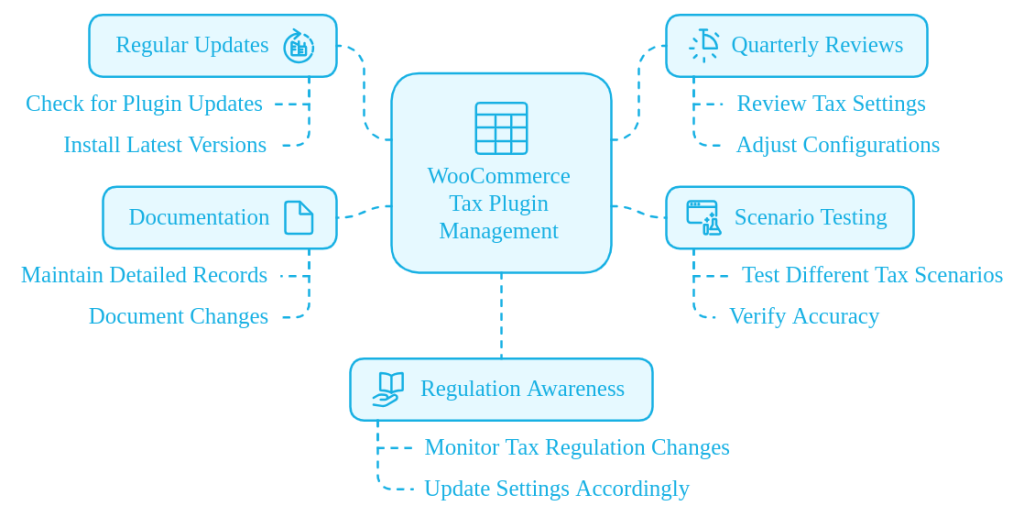

Pro Tips for WooCommerce Tax Plugin Management

Here are the important tips to effectively manage your WooCommerce tax with a plugin

- Regularly update your tax plugin

- Review tax settings quarterly

- Test calculations across different scenarios

- Maintain comprehensive documentation

- Stay informed about changing tax regulations

Relay is a user-friendly affiliate management tool that helps to grow your sales.

Conclusion

The right WooCommerce tax plugin isn’t just a tool—it’s like having your finance head. It will support tax calculation, accuracy, and compliance. A carefully chosen tax management system can save money, reduce stress, and help scale.

With this blog, you have all the information on the best WooCommerce tax plugins and tips to choose the right one for your business.

Further Reading

- 7 WooCommerce Shipping Plugins for Speedy Deliveries

- 9 best WordPress SMS plugins to engage customers

- 7 Best Contact Form plugin for WooCommerce in 2024

- 9 best WooCommerce product bundle plugins

Frequently Asked Questions

To add taxes on WooCommerce, navigate to WooCommerce -> settings -> Collect Sales Tax. Set rates for accurate tax calculations.

Yes, WooCommerce calculates sales tax based on location, product tax rate, and configured rates in the tax settings.

Use a WooCommerce tax plugin like Vertex or Avalara to automatically fetch and apply accurate tax rates for various jurisdictions.